With rising inflation, geopolitical turbulence and monetary policy tightening impacting their portfolios, high-net-worth individuals (HNWIs) in Asia-Pacific are repositioning their holdings with a renewed emphasis on protecting their private assets. Mitigating the effects of short-term market disruption to protect your wealth requires robust planning, and our innovative life insurance solutions can help you achieve peace of mind by safeguarding your assets.

Driven by surging food and energy 1 prices, rising inflation, tightening monetary policy and the war in Ukraine, global economic growth has slowed. Once a vital part of investors’ portfolios, selloffs in global equity markets have wiped out as much as US$1.4 trillion 2 from the fortunes of the world’s richest 500, leading HNWIs to reposition their portfolios.

Despite a strong economic rebound 3 from the pandemic in 2021, Asia-Pacific growth is forecast to slow down, threatening the financial stability and flexibility of many investors. In light of a weakening global outlook, strategic wealth planning will be essential in helping HNWIs protect their wealth, while continuing to achieve their financial priorities. So how are these individuals planning for a self-determined life in the face of global economic turmoil?

The flight to safety

With risk assets, from equities to cryptocurrencies, hit hard by volatility, a global flight to safety has seen investors adjust their portfolios and strategies, and Asia-Pacific investors are no exception.

In its 2021 survey of HNWIs in Asia-Pacific 4, private banking firm Lombard Odier highlights heightened caution among its survey respondents. Although differences exist between individual markets, as many as 44% of investors felt equity markets were too high and were likely to face additional corrections in the future.

With growth asset classes no longer offering the same attractive returns and more vulnerable to market shocks, investors in Asia-Pacific are pivoting their portfolios towards safer assets and private markets 5 to protect their wealth from market volatility. Among respondents in Australia and Indonesia, for instance, 60% of HNWIs 5 are planning on investing more money into private markets.

But while investors are changing their allocations to protect their wealth from market volatility, they are also seeking to hedge against inflation and ensure liquidity. Assets such as gold, in particular, are seen as effective hedges against inflation, partly explaining the surge in the price of gold to record levels in March 2022. It's clear that HNWIs are turning to assets that can protect against market disruption, providing the flexibility needed to enable strategic wealth planning.

Creating more diversified portfolios

But the reallocation of funds towards more defensive assets isn’t the only strategy HNWIs in Asia-Pacific are undertaking. Across the region, strong domestic biases exist, with some investors having concentrated exposure to individual markets.

And it’s not just portfolios that are heavily concentrated. Some markets are also more exposed to certain sectors. The Australian stock exchange, for example, is 50% concentrated in financials and materials.

But high concentrations can carry risks, increasing vulnerability to market- or sector-specific shocks. An example of this is the ongoing equities correction in China, which has seen foreign investors withdraw billions in USD.

In addition, some traditionally defensive assets can also be subject to unexpected market shocks. The recent UK gilts crisis showed that even safe-haven investments are not without risks. As yields spiked sharply in response to the UK government’s ill-fated mini-budget, foreign investors dumped UK government bonds at the fastest pace on record. Meanwhile, many UK pension funds that had held gilts as collateral for their liability-driven investment strategies, found themselves facing unprecedented margin calls and only survived through timely intervention from the Bank of England.

These examples show how important it is for HNWIs to diversify their portfolios away from single markets and sectors and even reconsider their assumptions about ‘safe-haven’ assets. A successful diversification strategy not only minimises the downside risk of individual market shocks, but also offers investors flexibility to respond to future economic events.

Diversifying from local portfolios to global ones requires rigorous planning to ensure objectives can be met while maintaining liquidity – an essential feature of protecting wealth 6.

A generational divide

Although HNWIs are responding to market volatility with caution, the willingness of younger investors to make changes to their portfolios highlights a generational divide when it comes to responding to heightened market risks.

Research from UBS shows that investor optimism has waned, with three in four 7 investors concerned about making the wrong investment decision, preferring to hold on to cash instead of making large purchases.

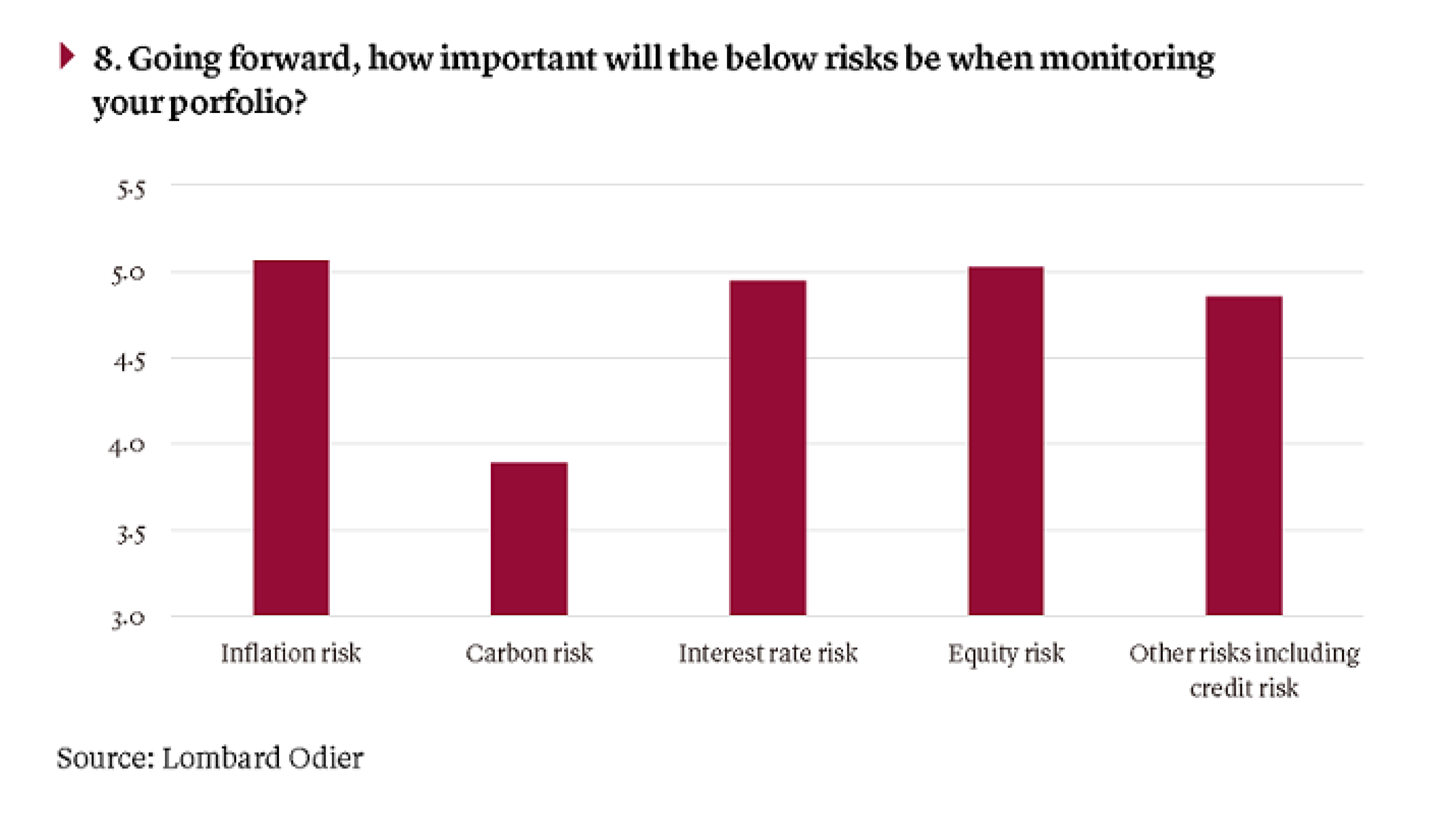

And, when asked to identify risks most relevant to their portfolios , respondents in the Lombard Odier survey identified inflation, interest, equity and credit risks as all posing a similar level of risk, suggesting investors perceive a wide range of different threats as poising a risk to their assets..

But while investors are aware of these risks, a clear age divide exists: the younger an individual is, the more willing they are to recalibrate their portfolio in response. 55% of investors aged 18-24 4 were willing to change the characteristics of their portfolio, compared with 48% of 35–50-year-olds, 42% of 51-70s, and only 23% of over 70s.

With older investors less prepared to change their portfolio’s characteristics in the face of market turbulence, these investors face growing risks to their wealth and their ability to achieve their financial objectives. These investors might need to be coached to make the changes required to their investments to protect their wealth in the face of continuing market volatility and economic uncertainty.

Protecting your wealth for future generations

With market disruption impacting the wealth of HNWIs around the world, many are taking steps to protect their wealth. From diversifying portfolios towards private markets or alternatives to moving money to safer assets, there are important steps individuals can take to protect their wealth and ensure they, and their families, can continue to lead a self-determined life.

Protecting wealth means ensuring the right liquidity and flexibility to meet future ambitions and for future generations. At Swiss Life, we offer liquidity planning solutions aiding the wealth transfer needs of our clients, steering them through the process of strategic wealth planning, with constant support along the way.

Wealth, just like your health, must be carefully preserved, and successful planning will help make your wealth last for you and future generations. Diversification and flexibility are of immense value at any time, especially in times of uncertainty, urging the wealth community to drive both towards diversification and security for the wealth of their clients.

Life insurance can be more than just a death benefit. When properly structured and managed, it can provide a universe of benefits including additional income streams, asset growth, investment diversification benefits, business owners’ protection and maximisation of estate values, all which are important for providing long-term security for policyholders and future generations.

Sources:

[3] https://www.imf.org/en/Publications/REO/APAC/Issues/2022/10/13/regional-economic-outlook-for-asia-and-pacific-october-2022

[4] https://asia.lombardodier.com/files/live/sites/loasiaportail/files/Documents/HNW/A_study_of_Asia-Pacifics_HNWI.pdf

[7] https://www.ubs.com/global/en/media/display-page-ndp/en-20220803-en-20220803-investor-sentiment.html

Contact us to discuss our life insurance solutions

by phone or video, your choice, we are flexible